Investors' Exchange 2018Soak up practical, proven investing methodologies that work in today's market

Discover Practical and Proven Investing Methodologies Optimised for Today's Market

Glimpse into the thought processes of practicing investors

Value Growth Investing That Works in 2018

Stanley & James will be revealing their strategies to picking out profitable value growth stock in 2018's volatile markets.

Dividend Investing For A Living?

Look forward to Brian, Rusmin and Christopher's strategies on how they find and build a portfolio that keeps paying them.

The stock market in 2018 thus far:

Did you manage to ride the waves of volatility and take advantage of the opportunities?Or are you still struggling to find the 'perfect' stock?BIGScribe is back with another edition of Investors Exchange (click to grab a ticket now)This year's Investors' Exchange will feature individual do-it-yourself investors who are like us. Some of them have day jobs that are not related to investing or even finance. Most of them started investing with a small budget and capital too.The criteria for this year's speakers:"They should be active investors who are willing to share the same strategy that they are using to grow their own money and portfolio."We had enough of keyboard warriors throwing out strategies on forums (most without any proof that it works).So this year, we are making it real.You will learn only practical and proven investing insights that you can apply in 2018 to grow your own money.Speakers have been chosen based on their investing methodologies.

You'll Pick Up Valuable, Actionable Investing Tips From:

Value Growth Investing

Stanley, Value Invest Asia

Stanley is currently the chief editor of Value Invest Asia. Over the course of his career, he has written close to 2000 articles online, on investment education and market analysis. Stanley is the co-writer of the Asia-focused investment book: “Value Investing In Asia“.He'll be sharing about "Spotting growth stocks in today's market" where you'll learn about:Is cheap stocks really 'good'?Economic Moat: what is it and why investors like you must exploit thisCase studies of real stocks and more

James, Small Cap Asia

James Yeo is the founder of Small Cap Asia, where he and his team aims to help investors get the best deals out of their investments. He is a financial analyst by profession and focuses on growth investing through small cap stocks. We're up for a treat as he reveals his 'GARP' Investing Strategy and give you the steps to use the strategy to grow your money as he shares:What is GARP Investing, and why you'll be able to pick stocks that help you grow your wealth with it,Who are the proponents of GARP approach, and what you must look out for in a GARP stock How to value a GARP stock within an hour2 Bonus Indicators that will finetune your GARP stock analysis3 Case Studies that reveal how the GARP strategy works in the markets

Dividend Investing

Brian Halim, ForeverFinancialFreedom (3Fs)

Brian is the writer behind foreverfinancialfreedom. He is currently pursuing his choice of financial freedom and he has a passion for dividend investing and loves traveling together with his family.He will be revealing "The Evolution of Dividend Strategy", where he will take you through:Your ultimate goal as a Dividend investors,How you should match your personal risk appetite to your investing strategy of choice,Advantages (and disadvantages) of Dividend investing over Growth investingDifferent types of Dividend Investing Strategies that you'll want to use to grow your dividend incomeReal Stock Case StudyA peak into 3FS' current portfolioand more

Rusmin, Fifth Person

Rusmin is the co-founder of The Fifth Person, and the co-author of the book 'Value Investing in Growth Companies'. He had been featured on Channel News Asia and 938 Live multiple times for his views and opinions on how to invest successfully in the stock market.He'll reveal: How You Can Build A Consistent Stream Of Passive Income and Maximise Your Dividends with Stock Investing, as well as:3 Essential Identifiers of a Profitable Income StockHow You Can Find Predictable Stock in Today's Markets1 Fool-Proof Strategy To Maximise Your Investing YieldHow to Determine The Best Time to Invest in a StockCase Studies of Real Businesses and Profitable Stocksand Many More...

Ultimate Goal of Investing

How a regular Singaporean managed to retire at 38 while building his family and raising two kids.

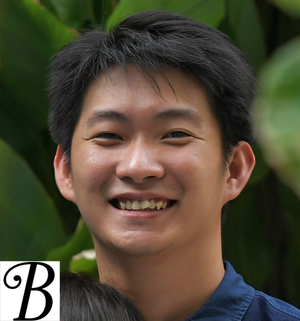

Christopher, Growing Your Tree of Prosperity

Christopher is the financial blogger behind the blog Growing Your Tree of Prosperity. He earned his financial independence at age 39 and has recently completed his Juris Doctor degree. Christopher was featured in Me and My Money sections in the Sunday Times, and has written about his journey in 3 popular personal finance books.Christopher will be sharing how he attained financial independence at 39 using the concept of F.U. Money (Freedom Unlimited). You'll discover:What is F**U** Money and how you can own some3 processes that will allow you to build up your F**U** MoneyHow you can retire earlier by understanding the concept of FIREHow you can FIRE fasterand more

Grab A Ticket Now

Investors Exchange 2018

14th July 2018 (Saturday)1 pm to 5 pmDBS Auditorium, Marina Bay Financial Centre Tower 3Ticket Price: S$65Early Bird Discount: S$49 [Only valid till 30th Jun]Limited only to 230 seats!UPDATE 30th Jun: 5 Left!Grab a ticket now and enjoy an early bird discount too:

![]()

What To Expect

Ok, enough talk.Here's a sneak peek to the juicy content we've lined up for you. How Stanley and James consistently uncover profitable value growth stocks to grow their wealth, even when the general markets did not provide obvious opportunities.How Brian optimised dividend investing and grow his dividend income, that allows him to stay on track to retiring at 35.How Christopher hacked DIY investing to retire at 39 and finance his lifestyle solely using dividends from his stock investments. The speakers are due to reveal some of their intimate (investing) secrets. In fact, we are raring to learn from the speakers ourselves~

And...We want you to be able to use what you've learnt!

It's always eye opening to hear directly from small investors like us who have made it in the stock markets.But, how does 1 investing methodology fit into our journey to financial independence?A few questions will immediately come to mind:How long should we be prepared to invest?How much returns should we aim for, realistically?How can we protect our downside so that our plan does not get affected by a single bad move in the market?and moreTo help answer these questions and more, we've decided to beef up Investors Exchange 2018 with a panel discussion.We'll bring these successful speakers together and stress test their investing and wealth building systems, so that you will gain additional insights on how you can apply their strategies into your journey to financial independence.Of course, we'll be opening the floor for questions. So, go ahead and ask the tough questions on investing that you've always wanted to know [Nope, "which stock to buy" doesn't count!]

![]()

Who Should Be Here

Aspiring investors, struggling investors and investors who want to find potential opportunities in the market that they can exploit in 2017 for greater returns.And...readers of Singapore finance blogs. Come by to learn, support and interact directly with some of Singapore's top finance bloggers, and put a face to the words and sharing that you often read online.

Why You Should Be Here

Ever wish someone could just share all the no BS, no fluff investing knowledge that they have gained from their experience in the real market, by investing real money....without having any hidden agenda?Well, that is the Investor Exchange in a nutshell.Your ticket includes all the investing knowledge from experienced investors, and a quick tea break. That's all.Keep your credit cards at home because there's nothing to buy.But, bring along your notepad to take notes.

Frequently Asked Questions

What's included with my ticket?

On top of the content packed line up, there will also be a tea break during the Investors Exchange 2017.Light snacks will be provided.Plus, you get to network with the speakers and some of the BIGScribe bloggers who will be in the audience, as well as fellow like-minded investors and aspiring investors.

Can we walk-in and purchase tickets on the actual day?

No.Firstly, we are likely to sell out the event before the actual day. Second, we are strictly not allowed to accept registrations above the stated seat limit for safety issues.More importantly, why would you want to wait and decide only on the day itself when we have an early bird promotion that will help you save around 25%?Commit to your investing education early and be rewarded.

Will slides be sent to us after the event?

No.Many of the information that you are about to learn and receive will be revealed only behind closed doors. We respect the speakers and their effort for preparing their content. Hence, no slides will be made available for mass distribution.You are allowed to take photos, take notes and ask questions. All of which will make a greater impact on your investor education compared to receiving a powerpoint slides dump that becomes a crutch to your learning instead.